Discover Bitcoin’s surge to $50,000 fueled by spot ETF launches and increasing investor demand.

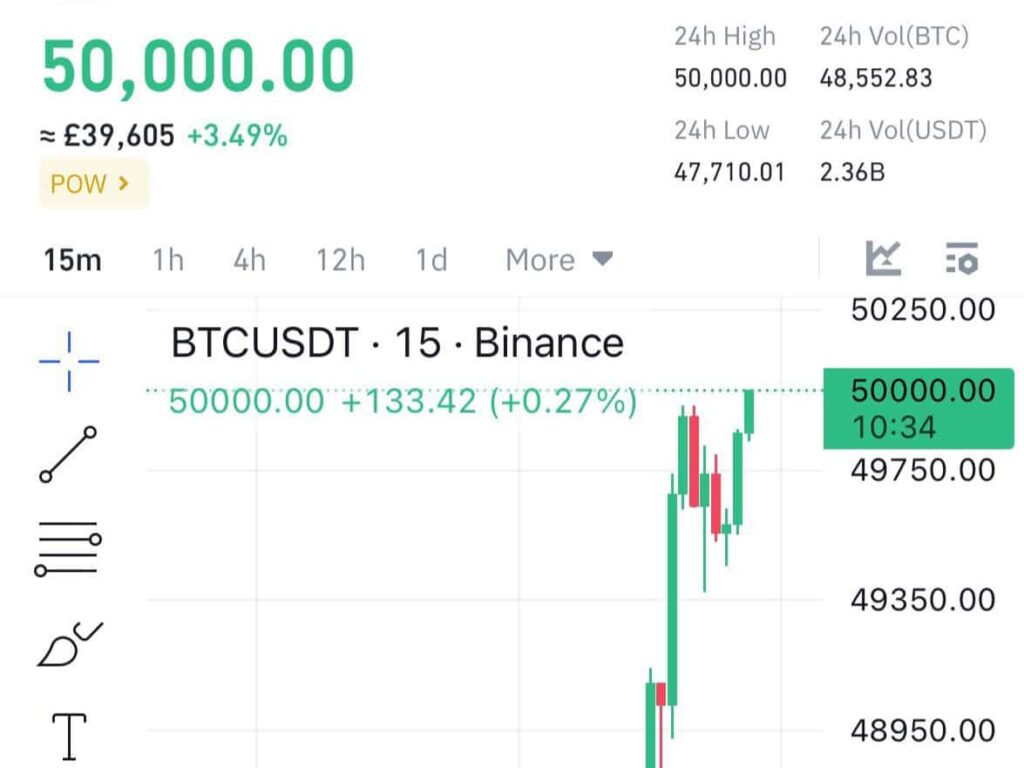

Bitcoin’s Milestone: Surging Past $50,000

In a significant milestone for the cryptocurrency market, Bitcoin’s price has soared above $50,000, reaching levels not seen since 2021. This surge in value underscores a notable shift in investor sentiment and appetite for digital assets, fueled in large part by the launch of mainstream Bitcoin investment funds earlier this year.

The flagship cryptocurrency’s ascent has been remarkable, with a nearly 15% increase since the beginning of the year. This surge can be attributed largely to the decision by the US Securities and Exchange Commission (SEC) to approve several spot Bitcoin exchange-traded funds (ETFs). These vehicles offer investors a regulated way to gain exposure to the price of Bitcoin, signaling a new era of accessibility and legitimacy for the cryptocurrency market.

Also Read:- The Winter Storm Warning is also in effect for most of Massachusetts, including Springfield, Worcester and Boston.

The approval of spot Bitcoin ETFs by prominent financial institutions, including BlackRock, the world’s largest asset manager, has been met with anticipation and excitement. However, despite the optimism surrounding their launch, Bitcoin experienced a brief dip in price, dropping roughly 15% in the days following the SEC’s approval. This volatility highlights the unpredictable nature of cryptocurrency markets and the complexities of investor sentiment.

Nevertheless, Bitcoin’s recent surge to $50,000 marks a significant milestone for the cryptocurrency and the broader digital asset ecosystem. It reflects growing confidence among investors in the long-term potential of Bitcoin as a store of value and a hedge against inflation.

Analysts have noted that the influx of new money into the market, driven by the introduction of Bitcoin ETFs, has played a key role in driving Bitcoin’s price higher. This influx of institutional capital represents a turning point for Bitcoin, as it transitions from a niche asset favored by early adopters to a mainstream investment option embraced by a wider range of investors.

Also Read:- Unraveling Alaskapox: Alaska Reports First Fatality from Newly Emerged Viral Disease

James Butterfill, head of research at crypto investment group CoinShares, commented on the evolving dynamics of Bitcoin investment: “Following a disappointing launch of several Bitcoin ETFs, we’re now seeing continued inflows into newly issued funds, and I think we’re seeing much more organic demand for Bitcoin as a result.”

The success of newly approved Bitcoin ETFs is evident in the significant inflows they have attracted. According to data from CoinShares, these ETFs have pulled in approximately $3 billion in net flows, despite facing competition from established products such as Grayscale Investments’ converted Bitcoin trust.

As Bitcoin ETFs gain traction among investors, there is growing optimism that mainstream adoption of digital assets will continue to expand. Issuers believe that traditional investors will gradually allocate a portion of their portfolios to Bitcoin ETFs, alongside more traditional investments in stocks and bonds.

Tim Huver, managing director at Brown Brothers Harriman, commented on the potential for increased adoption of Bitcoin ETFs: “I think it’s something where you’ll start to see a specific allocation to that over time with the longer track record. I think we’ll see increasing adoption and interest in that space.”

Kathy Kriskey, senior alternatives ETF strategist at Invesco, echoed this sentiment, emphasizing the importance of diversification: “One of the most important things is understanding the value of getting off zero. Investors could start by taking 1 percent from their equity exposure and reallocating it to Bitcoin.”

In addition to the growing interest from institutional investors, Bitcoin has also benefited from positive macroeconomic factors. Expectations of central bank interest rate cuts and Bitcoin’s upcoming supply reduction event, known as the “halving,” have contributed to optimism among investors.

Also Read:- Resignation Amid Controversy: Hungarian President Katalin Novak’s Pardon Decision Sparks Political Turmoil

Despite these bullish indicators, some analysts remain cautious about Bitcoin’s future trajectory. Jim Angel, a faculty affiliate at Georgetown McDonough’s Psaros Center for Financial Markets and Policy, highlighted the inherent volatility and uncertainty of the cryptocurrency market: “The price of Bitcoin will always fluctuate violently based on the number of true believers that want to buy, and the number of skeptics that want to sell.”

As Bitcoin continues to capture the attention of investors worldwide, its journey towards mainstream adoption and acceptance is far from over. The recent surge past $50,000 is a testament to Bitcoin’s resilience and enduring appeal as a transformative asset in the digital age.